Blog

Tax Incentives for Switching to Solar Power in 2023

If you have been considering transitioning your household to solar energy power, it has just been announced that 2023 is the best year to do it. Due to tax incentives taking place this year, you will save more money on your investment in solar energy than ever before.

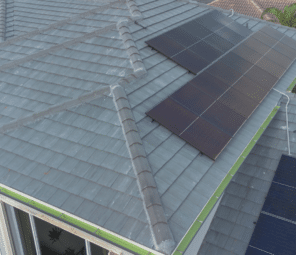

The cost of installing solar panels has significantly decreased in the past couple of years, and tax credits will help you to reach your guaranteed return on investment even faster.

Tax Incentives for Installing Solar Panels This Year.

Some of the credits included in the act are Residential Energy Credits. These credits are provided in connection with household investments in clean, renewable energy sources.

The Residential Energy Credits offer a 30% credit of your costs in installing solar panels towards your federal taxes. This current credit is the largest credit towards solar energy ever seen.

By filling out Tax Form 5695 homeowners will receive credit towards their solar energy purchases, including solar electricity, solar water heating, small wind energy, geothermal heat pumps, and qualified fuel cell property cost.

While the installation of solar panels is an upfront investment, it comes with a guaranteed return on investment. Once you break even on the installation cost, you will see a significant difference from your previous energy bill, as the average price of solar energy is only $2.86 per watt.

Other clean energy purchases that are covered under the Residential Energy Credits include electric vehicles, biodiesel, renewable diesel, and alternative fuels.

Other Incentives for Installing Solar Panels

Aside from saving money, the transition to solar energy comes with many other positive outcomes. The goal is to decrease the burning of fossil fuels, a non-renewable resource which contributes to current environmental issues like climate change and the global warming of our planet.

Solar energy is a reliably self-sufficient energy source. Those who will transition to renewable resources this year will be independent of an energy company and, therefore, no longer at will to the increasing prices of non-renewable energy bills.

You will feel the personal gratification that comes with using an energy source that does not harm the environment. Rotraut Bockstahler, 86, of Sarasota, Florida, and her husband referred to their household transition to solar as “one of the most positive decisions we made for our living in Florida. We have saved money, made a contribution to fighting climate change and were fortunate enough to have electricity every time there was an outage in the electric grid.”

How to Take Advantage of the 2023 Solar Panel Tax Incentives

How to Take Advantage of the 2023 Solar Panel Tax Incentives

In 2023, your investment towards solar power is eligible for a 30% tax credit, the largest seen yet. Solar energy brings not only the reward of saving money but also the gratification that you are helping to contribute to the health of our planet.

Here at Bison Roofing & Solar, we would be happy to help your household take advantage of this year’s incentives for transitioning to solar energy. Our company knows that, like any other investment, our clients are on the lookout for the best company and materials when it comes to the roofing of their homes.

We have enjoyed completing over 500 installations of the best roofing and solar materials and are honored to hold a 4.7 Google Rating of satisfied customers. 2023 is the best year yet to make your home a solar energy-powered home, and be rewarded for it. Contact us today to get started!

How to Take Advantage of the 2023 Solar Panel Tax Incentives

How to Take Advantage of the 2023 Solar Panel Tax Incentives